Understanding How Does Golden Visa Work For Investors

- Melissa Gonçalves

- Sep 26, 2025

- 8 min read

Golden Visas are reshaping how wealthy individuals secure their plans for the future. Some programs require as little as €250,000 of investment and only seven days per year of physical presence to keep your residency. People often imagine immigration takes years of complicated paperwork and endless waiting. In reality, these programs offer a discreet shortcut that transforms residency into a clear-cut financial choice.

Table of Contents

Quick Summary

Takeaway | Explanation |

Golden Visas require significant financial investment. | Minimum investments typically range from €250,000 to €2 million, depending on the country’s program. |

They provide mobility and personal security advantages. | Investors gain access to stable legal systems and can relocate quickly in uncertain conditions. |

Multiple investment channels are available. | Options include real estate, funds, and capital transfers, allowing for diversified investment strategies. |

Pathway to citizenship is possible. | Investors can progress from residency to permanent residency or citizenship, enhancing their global standing. |

Regulatory vigilance is crucial. | Investors must stay updated on changing laws and compliance requirements that could affect their status and investments. |

What is a Golden Visa and its Purpose?

A Golden Visa represents a specialized residency investment program that enables foreign investors to obtain legal residency in a host country through significant financial contributions. Investor migration programs have emerged as strategic mechanisms for nations seeking to attract foreign capital and talent while providing investors unique mobility and settlement opportunities.

The Core Concept of Golden Visa Programs

Golden Visa programs are sophisticated immigration pathways designed to connect global investors with countries offering strategic residency benefits. These programs fundamentally operate on a simple premise: substantial financial investment in exchange for legal residency status. Unlike traditional immigration routes that prioritize employment skills or family connections, Golden Visa programs focus on direct economic contributions.

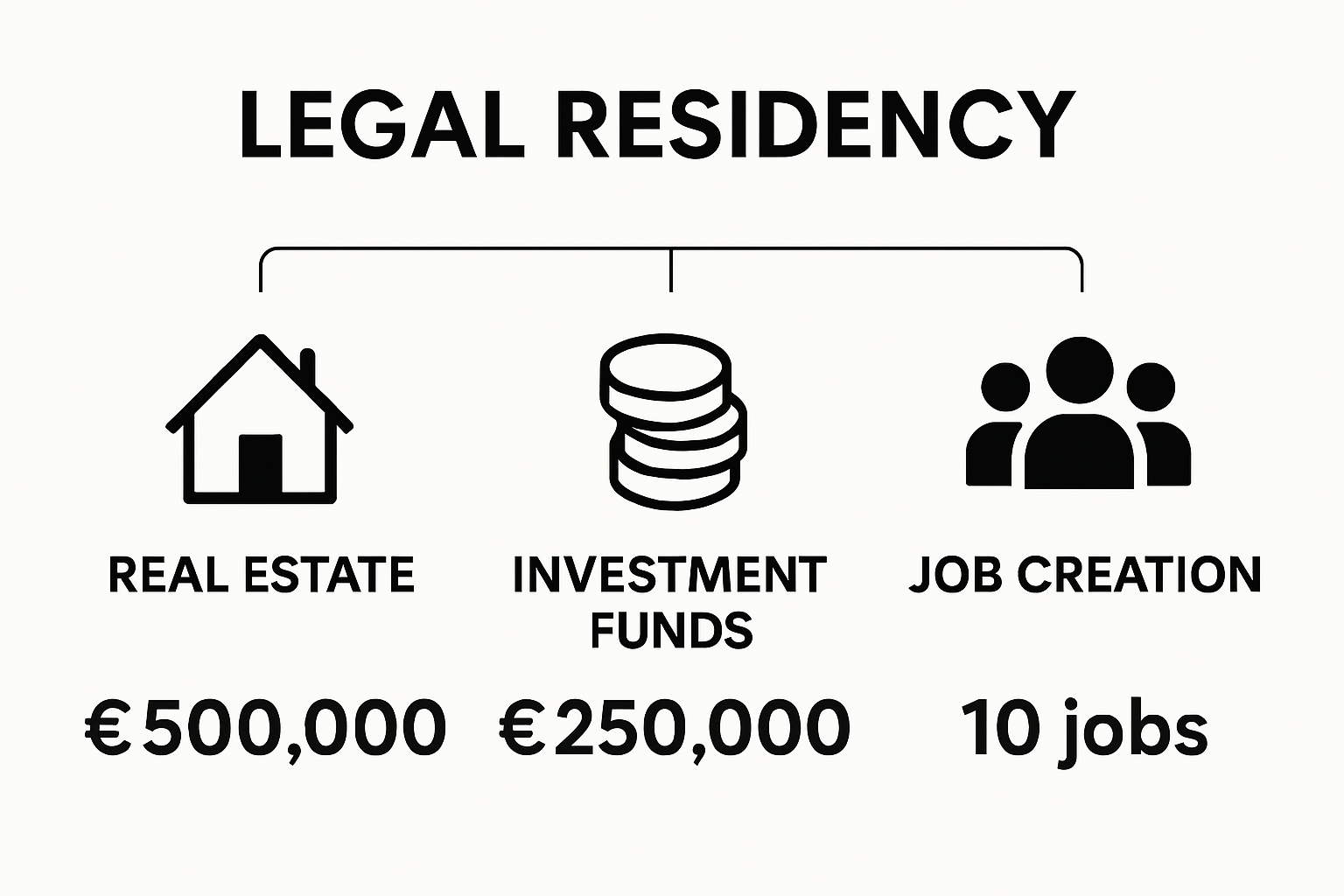

Key characteristics of Golden Visa programs typically include:

Minimum investment thresholds ranging from €250,000 to €2 million

Multiple investment channel options such as real estate, investment funds, job creation, or capital transfers

Potential pathway to permanent residency or citizenship after meeting specific criteria

Flexibility in physical residency requirements

Economic and Strategic Motivations

Countries implement Golden Visa programs as sophisticated economic development tools. OECD analysis reveals these schemes are calculated strategies to stimulate foreign direct investment, attract high-net-worth individuals, and inject capital into specific economic sectors. For investors, these programs offer more than mere residency—they represent comprehensive lifestyle and financial planning solutions.

While individual program details vary, the overarching goal remains consistent: creating mutually beneficial frameworks where investors gain enhanced global mobility and host countries receive substantial economic investments. For those interested in exploring alternative investment pathways, read our comprehensive guide on Golden Visa alternatives to understand the broader landscape of investment migration strategies.

Why Are Golden Visas Important for Investors?

Golden Visa programs represent far more than simple residency permits; they are strategic instruments for global investors seeking comprehensive personal and financial security. International mobility research demonstrates these programs offer multifaceted advantages that extend well beyond traditional immigration pathways.

Personal Security and Global Mobility

For high-net-worth individuals, Golden Visas function as critical risk management tools. They provide a legal mechanism to establish alternative residency, offering a strategic backup plan in environments with political instability, economic uncertainty, or restrictive personal freedoms. Investors gain the ability to relocate quickly, maintaining personal and financial flexibility across international jurisdictions.

Key personal security benefits include:

Protection against sudden geopolitical shifts

Access to stable, democratic legal systems

Potential emergency relocation options

Enhanced personal and family safety

Financial and Strategic Advantages

Beyond personal security, Golden Visas offer sophisticated financial planning opportunities. European Parliamentary research689364_EN.pdf) highlights these programs as strategic wealth diversification mechanisms. Investors can simultaneously secure residency rights while positioning investments in economically robust environments with strong regulatory frameworks.

Financial advantages encompass:

Portfolio diversification across international markets

Access to advanced banking and investment ecosystems

Potential tax optimization strategies

Long-term wealth preservation opportunities

For investors seeking deeper insights into strategic investment approaches, our comprehensive guide explores investment fund options within Golden Visa programs, providing nuanced perspectives on maximizing investment potential.

How Does the Golden Visa Work in Portugal?

Portugal’s Golden Visa program stands as a sophisticated investment migration pathway designed to attract foreign capital while offering investors strategic residency opportunities. Portuguese Immigration Authority regulations provide a structured framework enabling non-EU investors to obtain residency through carefully defined investment channels.

Investment Pathways and Requirements

The Portuguese Golden Visa offers multiple investment routes, each with specific financial thresholds and strategic considerations.

Investors can choose from several investment channels, including fund investments, job creation, and capital transfers. The primary investment options typically require a minimum investment ranging from €250,000 to €500,000, depending on the chosen pathway.

The following table summarizes the main investment channels available under Portugal’s Golden Visa program, including the minimum investment required and the strategic focus of each option.

Investment Channel | Minimum Investment (€) | Strategic Focus |

Investment Funds | 250,000 - 500,000 | Portuguese economic development |

Capital Transfers | 250,000 - 500,000 | National initiatives and economic stimulation |

Job Creation | – | Employment opportunities for Portuguese residents |

Scientific Research | 250,000 | Advancement of scientific knowledge |

Cultural Heritage Preservation | 250,000 | Preservation of arts and cultural assets |

Key investment channels include:

Investment funds targeting Portuguese economic development

Capital transfers supporting national strategic initiatives

Creating employment opportunities for Portuguese residents

Investing in scientific research and cultural heritage preservation

Residency and Citizenship Progression

Portugal’s Golden Visa program offers a structured pathway to long-term residency and potential citizenship. SEF Processing Guidelines outline a systematic approach where investors must maintain their investment and meet minimal physical presence requirements. Typically, investors must spend an average of seven days per year in Portugal to maintain their residency status.

Progression milestones involve:

Initial temporary residence permit valid for two years

Potential renewal contingent on investment maintenance

Pathway to permanent residency after five years

Option to apply for Portuguese citizenship

Learn more about our comprehensive guide to Portuguese Golden Visa application processes to understand the intricate details of navigating this investment migration strategy.

Key Concepts and Benefits of Golden Visa Programs

Golden Visa programs represent sophisticated global mobility solutions that transcend traditional immigration pathways.

This table provides a concise comparison of key benefits offered by Golden Visa programs, highlighting how they address both personal and financial needs for global investors.

Benefit Type | Description | Example Outcomes |

Global Mobility | Residency and travel rights in economically stable regions | Visa-free movement within Schengen area |

Personal Security | Legal safety net during geopolitical or economic instability | Emergency relocation options |

Wealth Diversification | Spreading assets across international markets | Portfolio diversification |

Legal Advantages | Access to established, democratic legal systems | Protection of family and property rights |

Pathway to Citizenship | Opportunity for permanent residency or citizenship | Eligibility after set residency period |

Global Mobility and Legal Advantages

At their core, Golden Visa programs provide investors unprecedented international flexibility. These programs grant holders strategic legal rights that include residency permissions, potential future citizenship tracks, and enhanced global movement capabilities. Participants gain the ability to navigate complex international legal landscapes with significantly reduced bureaucratic friction.

Key legal mobility benefits encompass:

Unrestricted travel within specific economic zones

Access to robust legal frameworks

Potential visa-free entry to multiple countries

Protection against sudden geopolitical disruptions

Financial and Strategic Opportunities

Beyond mobility, Golden Visa programs function as sophisticated wealth management instruments. International migration data demonstrates these programs allow investors to strategically diversify personal and financial risks across international jurisdictions. Investors gain access to advanced economic ecosystems that offer stability, regulatory transparency, and potential long-term wealth preservation strategies.

Strategic financial advantages include:

Exposure to alternative investment markets

Potential tax optimization opportunities

Enhanced asset protection mechanisms

Comprehensive family wealth planning capabilities

Our comprehensive guide explores alternative investment strategies within Golden Visa programs, providing deeper insights into maximizing global investment potential.

Navigating Challenges and Considerations in Golden Visa Investments

Golden Visa investments represent sophisticated financial strategies that require comprehensive due diligence and strategic planning. European Parliamentary research689364_EN.pdf) underscores the complex regulatory landscape investors must carefully navigate to ensure successful program participation.

Regulatory and Compliance Challenges

The dynamic nature of Golden Visa programs demands exceptional vigilance from potential investors. Regulatory frameworks can change rapidly, potentially impacting investment validity, residency status, and long-term strategic objectives. Investors must maintain ongoing awareness of legal modifications, compliance requirements, and potential shifts in program structure.

Key regulatory considerations include:

Frequent legislative updates affecting investment eligibility

Complex documentation and verification processes

Potential retroactive changes to existing investment conditions

Strict background screening and financial transparency requirements

Financial Risk Management

Successful Golden Visa investments require sophisticated financial risk mitigation strategies. Investors must assess not just immediate investment opportunities but also long-term economic implications. Comprehensive financial planning becomes crucial in managing potential currency fluctuations, tax implications, and investment performance across different jurisdictions.

Critical financial risk management strategies involve:

Diversifying investment portfolios

Conducting thorough due diligence on investment channels

Understanding potential tax implications

Maintaining flexible financial structures

Explore our comprehensive guide to alternative investment strategies to develop a robust approach to Golden Visa investments.

Transform Your Golden Visa Journey Into a Safe Investment Success

Navigating the Golden Visa process can be overwhelming if you want true residency security and financial growth but worry about changing regulations or risky investment choices. The article highlights key challenges for investors like balancing wealth preservation with compliance, understanding Portugal’s legal requirements, and choosing secure alternatives to real estate. At MFG Consultants, we translate these concerns into personalized action with strategies that protect your capital, prioritize due diligence, and offer full transparency at every step.

Discover how you can access regulated Portuguese investment funds tailored to your risk profile. We do the work behind the scenes, from screening each investment option to streamlining your legal process. If achieving residency and financial diversification without the uncertainty of direct property deals matters to you, now is the time to explore our independent solutions. Start your Golden Visa application confidently with MFG Consultants or get the details with our comprehensive guide on Golden Visa alternatives. Secure your future in Europe and build a legacy for your family today.

Frequently Asked Questions

What is a Golden Visa and how does it work?

A Golden Visa is a residency investment program allowing foreign investors to gain legal residency in a host country through significant financial contributions, typically involving investment in real estate, investment funds, or job creation.

What are the typical investment requirements for obtaining a Golden Visa?

Investment thresholds for Golden Visas usually range from €250,000 to €2 million, depending on the specific investment option chosen, such as real estate or capital transfers.

What benefits do investors gain from acquiring a Golden Visa?

Investors benefit from enhanced global mobility, potential pathways to permanent residency or citizenship, protection against political or economic instability, and financial advantages like portfolio diversification and access to advanced banking systems.

How does the process of obtaining a Golden Visa typically progress?

The process typically involves maintaining the investment, meeting minimum residency requirements, renewing temporary residence permits, and potentially applying for permanent residency or citizenship after a set period, which can vary by program.

Recommended

Comments